Main Body

13. Positive Externalities and Public Goods

Introduction to Positive Externalities and Public Goods

Chapter Overview

In this chapter, you will learn about:

- Investments in Innovation

- How Governments Can Encourage Innovation

- Public Goods

Bring It Home

The Benefits of Voyager I Endure

The rapid growth of technology has increased our ability to access and process data, navigate through a busy city, and communicate with friends on the other side of the globe. The research and development efforts of citizens, scientists, firms, universities, and governments have truly revolutionized the modern economy. To get a sense of how far we have come in a short period, let’s compare one of humankind’s greatest achievements to the smartphone.

In 1977, the United States launched Voyager I. The spacecraft was programmed to take and send back photographs and other cosmic measurements, and it was originally intended to reach Jupiter and Saturn. Voyager I, however, kept going. And going. It passed Jupiter and Saturn and traveled right out of our solar system. At the time of its launch, Voyager had some of the most sophisticated computing processing power NASA could engineer (8,000 instructions per second), but today, we Earthlings use handheld devices that can process 14 billion instructions per second.

Still, the technology of today is a spillover product of the incredible feats NASA accomplished over 40 years ago. For instance, NASA research is responsible for the kidney dialysis and mammogram machines that we use today. Research in new technologies not only produces private benefits to the investing firm, or in this case to NASA, but it also creates benefits for the broader society. In this way, new knowledge often becomes what economists refer to as a “public good.” This leads us to the topic of this chapter—technology, positive externalities, public goods, and the role of government in encouraging innovation and the social benefits that it provides.

What makes a smartphone smart? What allows its apps to help you navigate new towns while getting updates about your home, all while your hands are on the steering wheel and your children are in the back seat watching their shows? Economist Mariana Mazzucato explores these questions in her well-known work The Entrepreneurial State. The answer, for starters, is the internet, cell tower networks, GPS, and voice activation. All these technologies, and many other technologies we rely on, were developed with intensive government support. For example, GPS, which enables many cell phone functions beyond the frequently used mapping and ride-sharing applications, was developed by the U.S. Department of Defense over several generations of satellite tracking and complex computer algorithm development. The U.S. government still provides GPS for many of the world’s users.

We do not often think of the government when we consider our leading products and entrepreneurs. We think of Apple, Google, Lyft, Tesla, Fitbit, and so on—creative innovators who built on the tools provided by government efforts, using them in transformative ways. We may not think of the estimated $19 billion per year that the United States spends to maintain the GPS, but we would certainly think of it if it suddenly went away. (Beyond the impact on our daily lives, economists estimate U.S. businesses alone would lose about $1 billion per day without GPS.)

Mazzucato is one of several prominent economists advocating for an embrace of continued government-sponsored innovations to build economic prosperity, reduce inequality, and manage ongoing challenges such as drought, coastal changes, and extreme weather. She argues that competitive, private-sector markets are often resistant to the risks involved with large-scale innovation because failed experiments and a lack of uptake lead to massive corporate and personal losses. Governments can take on riskier research and development projects. Because government spending is fueled by taxpayers, and all innovation leads to some level of employment change, these proposals are certainly complex and challenging to implement.

This chapter deals with some of these issues. Will private companies be willing to invest in new technology? In what ways does new technology have positive externalities? What motivates inventors? What role should the government play in encouraging research and technology? Are there certain types of goods that markets fail to provide efficiently and that only the government can produce? What happens when the consumption or production of a product creates positive externalities? Why is it unsurprising when we overuse a common resource, like marine fisheries?

13.1 Investments in Innovation

Learning Objectives

By the end of this section, you will be able to:

- Identify the positive externalities of new technology.

- Explain the difference between private benefits and social benefits, and give examples of each.

- Calculate and analyze rates of return.

Market competition can provide an incentive for discovering new technology because a firm can earn higher profits by finding a way to produce products more cheaply or to create products with characteristics consumers want. As Gregory Lee, CEO of Samsung, said, “Relentless pursuit of new innovation is the key principle of our business and enables consumers to discover a world of possibilities with technology.” An innovative firm knows that it will usually have a temporary edge over its competitors and thus an ability to earn above-normal profits before competitors can catch up.

In certain cases, however, competition can discourage new technology, especially when other firms can quickly copy a new idea. Consider a pharmaceutical firm deciding to develop a new drug. On average, it can cost $800 million and take more than a decade to discover a new drug, perform the necessary safety tests, and bring the drug to market. If the research and development (R&D) effort fails—and every R&D project has some chance of failure—then the firm will suffer losses and could even be driven out of business. If the project succeeds, then the firm’s competitors may figure out ways of adapting and copying the underlying idea, but without having to pay the costs themselves. As a result, the innovative company will bear the much higher costs of the R&D and will enjoy at best only a small, temporary advantage over the competition.

Many inventors over the years have discovered that their inventions brought them less profit than they might have reasonably expected:

- Eli Whitney (1765–1825) invented the cotton gin, but then Southern cotton planters built their own seed-separating devices with a few minor changes to Whitney’s design. When Whitney sued, he found that the courts in the South would not uphold his patent rights.

- Thomas Edison (1847–1931) still holds the record for most patents granted to an individual. His first invention was an automatic vote counter, and despite the social benefits, he could not find a government that wanted to buy it.

- Gordon Gould came up with the idea behind the laser in 1957. He put off applying for a patent and, by the time he did apply, other scientists had laser inventions of their own. A lengthy legal battle resulted, in which Gould spent $100,000 on lawyers, before he eventually received a patent for the laser in 1977. Compared to the enormous social benefits of the laser, Gould received relatively little financial reward.

- In 1936, Alan Turing delivered a paper titled “On Computable Numbers, with an Application to the Entscheidungsproblem,” in which he presented the notion of a universal machine (later called the “universal Turing machine” and then the “Turing machine”) capable of computing anything computable. The central concept of the modern computer was based on Turing’s paper. Today, scholars widely consider Turing to be the father of theoretical computer science and artificial intelligence. However, the UK government prosecuted Turing in 1952 for engaging in same-sex sexual acts and gave him the choice of chemical castration or prison. Turing chose castration and died in 1954 from cyanide poisoning.

A variety of studies by economists have found that the original inventor receives one third to one half of the total economic benefits from innovations, while other businesses and new product users receive the rest.

The Positive Externalities of New Technology

Will private firms in a market economy underinvest in research and technology? If a firm builds a factory or buys a piece of equipment, the firm receives all the economic benefits that result from the investment. However, when a firm invests in new technology, the private benefits, or profits, that the firm receives are only a portion of the overall social benefits. The social benefits of an innovation account for the value of all the positive externalities of the new idea or product, whether enjoyed by other companies or society as a whole, as well as the private benefits the firm that developed the new technology receives. As you learned in Environmental Protection and Negative Externalities, positive externalities are beneficial spillovers to a third party or parties.

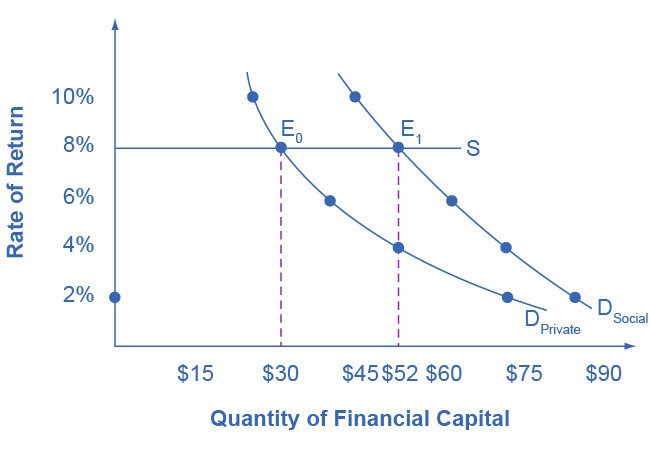

Consider the example of the Big Drug Company, which is planning its R&D budget for the next year. Economists and scientists working for Big Drug have compiled a list of potential research and development projects and estimated rates of return. (The rate of return is the estimated payoff from the project.) Figure 13.2 shows how the calculations work. The downward-sloping DPrivate curve represents the firm’s demand for financial capital and reflects the company’s willingness to borrow to finance research and development projects at various interest rates. Suppose that this firm’s investment in research and development creates a spillover benefit to other firms and households. After all, innovation often sparks other creative endeavors that society also values. If we add the spillover benefits society enjoys to the firm’s private demand for financial capital, we can draw DSocial that lies above DPrivate.

If there were a way for the firm to fully monopolize those social benefits by somehow making them unavailable to the rest of us, the firm’s private demand curve would be the same as society’s demand curve. According to Figure 13.2 and Table 13.1, if the going rate of interest on borrowing is 8%, and the company can receive the private benefits of innovation only, then the company would finance $30 million. Society, at the same rate of 8%, would find it optimal to have $52 million of borrowing. Unless there is a way for the company to fully enjoy the total benefits, then it will borrow less than the socially optimal level of $52 million.

|

DPrivate (in millions) |

DSocial (in millions) |

|

|---|---|---|

|

2% |

$72 |

$84 |

|

4% |

$52 |

$72 |

|

6% |

$38 |

$62 |

|

8% |

$30 |

$52 |

|

10% |

$26 |

$44 |

Big Drug’s original demand for financial capital (DPrivate) is based on the profits the firm receives. However, other pharmaceutical firms and health care companies may learn new lessons about how to treat certain medical conditions and then create competing products. The social benefit of the drug takes into account the value of all the drug’s positive externalities. If Big Drug were able to gain this social return instead of other companies, its demand for financial capital would shift to the demand curve DSocial, and it would be willing to borrow and invest $52 million. However, if Big Drug is receiving only 50 cents of each dollar of social benefits, the firm will not spend as much on creating new products. The amount it would be willing to spend would fall somewhere in between DPrivate and DSocial.

Check Your Learning

(Learning Outcome: Identify the positive externalities of new technology.)

Why Invest in Human Capital?

The investment in anything, whether it is the construction of a new power plant or research in a new cancer treatment, usually requires a certain upfront cost with an uncertain future benefit. The investment in education, or human capital, is no different. Over many years, a student and their family invest significant amounts of time and money into that student’s education. The idea is that higher levels of educational attainment will eventually serve to increase the student’s future productivity and subsequent ability to earn. Once the student crunches the numbers, does this investment pay off for the student?

Almost universally, economists have found that the answer to this question is a clear “Yes.” For example, several studies of the return on education in the United States estimate that the rate of return to a college education is approximately 10–15%. Data in Table 13.2, from the U.S. Bureau of Labor Statistics’ Usual Weekly Earnings of Wage and Salary Workers, Fourth Quarter 2021, demonstrate that median weekly earnings are higher for workers who have completed more education. Although these rates of return will beat equivalent investments in Treasury bonds or savings accounts, the estimated returns on education go primarily to the individual worker, so these returns are private rates of return to education.

|

|

Less than a high school degree |

High school degree, no college |

Bachelor’s degree or higher |

|

Median weekly earnings (full-time workers over the age of 25) |

$651 |

$831 |

$1,467 |

What does society gain from investing in the education of another student? After all, if the government is spending taxpayer dollars to subsidize public education, society should expect some kind of return on that spending. Economists like George Psacharopoulos have found that, across a variety of nations, the social rate of return on schooling is also positive. After all, positive externalities exist from investment in education. Although they are not always easy to measure, according to Walter McMahon, the positive externalities of education typically include better health outcomes for the population, lower levels of crime, a cleaner environment, and a more stable, democratic government. For these reasons, many nations have chosen to use taxpayer dollars to subsidize primary, secondary, and higher education. Education clearly benefits the person who receives it, but a society where most people have a good level of education provides positive externalities for all.

Other Examples of Positive Externalities

The Economics of the COVID Vaccine

How can understanding externalities and incentives help us better respond to COVID-19? Preventive health care often creates positive externalities. One of the consequences of positive externalities is the under-allocation of resources. To correct this problem, the government either has to subsidize or provide preventive care free of cost to consumers. Vaccination falls in the category of preventive care. The following video explains the economics of the COVID vaccine and how vaccination creates positive externalities.

Although technology may be the most prominent example of a positive externality, it is not the only one. For example, vaccinations against disease not only provide protection for the individual, but also have the positive spillover effect of protecting others who may become infected. When a number of homes in a neighborhood are modernized, updated, and restored, it not only increases the homes’ value, but also may increase the values of other properties in the neighborhood.

The appropriate public policy response to a positive externality, such as a new technology, is to help the party that is creating the positive externality receive a greater share of the social benefits. In the case of vaccines like flu shots, an effective policy might be to provide a subsidy to those who choose to get vaccinated.

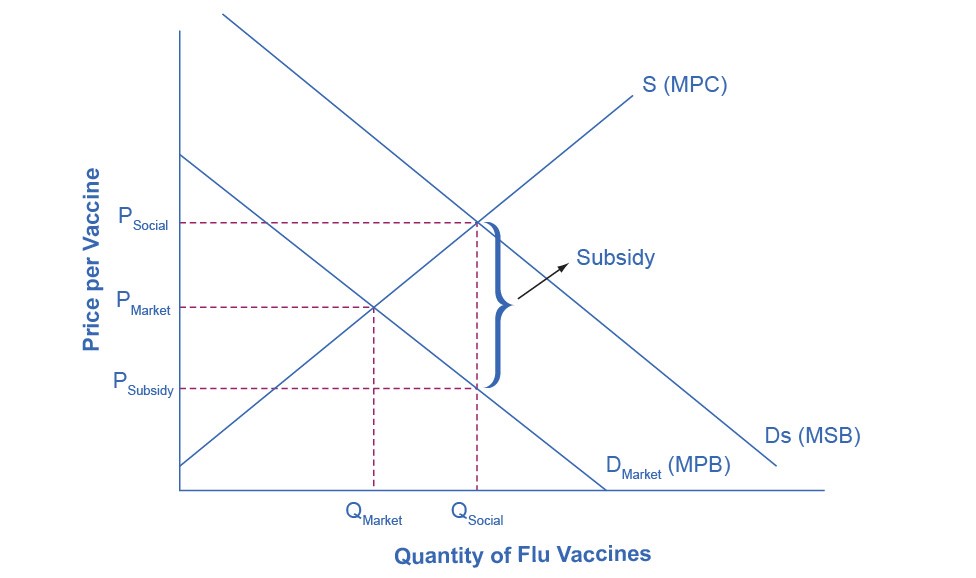

Figure 13.3 shows the market for flu shots. The market demand curve DMarket for flu shots reflects only the marginal private benefits (MPB) that the vaccinated individuals receive from the shots. Assuming that there are no spillover costs in the production of flu shots, the market supply curve is given by the marginal private cost (MPC) of producing the vaccinations.

The equilibrium quantity of flu shots produced in the market, where MPB is equal to MPC, is QMarket, and the price of flu shots is PMarket. However, spillover benefits exist in this market because others—those who choose not to purchase a flu shot—receive a positive externality in the form of a reduced chance of contracting the flu. When we add the spillover benefits to the marginal private benefit of flu shots, the marginal social benefit (MSB) of flu shots is given by DSocial. Because the MSB is greater than MPB, we see that the socially optimal level of flu shots is greater than the market quantity (QSocial exceeds QMarket) and the corresponding price of flu shots, if the market were to produce QSocial, would be at PSocial. Unfortunately, the marketplace does not recognize the positive externality, and flu shots will go under-produced and under-consumed.

How can the government try to move the market level of output closer to the socially desirable level of output? One policy would be to provide a subsidy, like a voucher, to any citizen who wishes to get vaccinated. This voucher would act as “income” that one could use to purchase only a flu shot and, if the voucher were exactly equal to the per-unit spillover benefits, would increase market equilibrium to a quantity of QSocial and a price of PSocial, where MSB equals MSC (which equals MPC given the assumption that there are no spillover costs in producing the vaccine). Suppliers of the flu shots would receive payment of PSocial per vaccination, while consumers of flu shots would redeem the voucher and only pay a price of PSubsidy. When the government uses a subsidy in this way, it produces the socially optimal quantity of vaccinations.

Societal Change as an Innovation Outcome

Economist Carlota Perez draws on the lessons of past innovations to understand the current state of our economy. She demonstrates that prior technological turning points, such as the proliferation of railroads and the emergence of mass production, created initial periods of employment and wealth shifting but eventually led to greater well-being and economic growth. After difficult transition periods and occasional economic meltdowns during the “installment” phase of widespread new technologies, many economies and the people within them have benefited from prolonged periods of economic and lifestyle improvement, including lower unemployment and better quality of life.

Most prior innovative periods, such as the Industrial Revolution, had one significant downside: negative impacts on the environment, such as pollution and habitat destruction. Perez notes that our current revolution in information and communications technology (ICT) has the potential for significant positive externalities related to the environment. ICT is shifting many areas of society, and therefore industry, to digital experiences and services that do not require fossil fuels or similar natural resources. Vehicle sharing, product rental-reuse networks, and new manufacturing methods offer the promise of far less consumable consumption. And even though the appearance of delivery trucks and shipping boxes gives the impression of environmental damage, most studies indicate that online shopping is better for the environment than individuals shopping in person. (This is partly attributed to greater efficiency in a few trucks driving to a neighborhood rather than everyone in the neighborhood driving separate cars to several stores.) Consumers and governments can spur on those environmental benefits by choosing or partnering with companies that focus on furthering their environmental impact, such as by using solar power to fuel their computer servers or by using electric delivery trucks.

Like other innovations, ICT has created some employment and economic opportunities, and it has reduced others. Increased globalization and efficiencies have shuttered businesses and reduced wages in some areas. Perez’s research indicates that those types of employment shifts can be managed through proper regulation and investment (especially in human capital), particularly as firms in the relevant industries become mature and profitable. The prospects aren’t simple. ICT has created megafirms like Amazon and Apple, which, despite pleasing their consumers, can wield significant power over governments and employees. But on the environmental and societal front at least, ICT has offered a wealth of opportunities and externalities.

Key Concepts and Summary

13.1 Investments in Innovation

Competition creates pressure to innovate. However, if one can easily copy new inventions, then the original inventor loses the incentive to invest further in research and development. New technology often has positive externalities—that is, there are often spillovers from the invention of new technology that benefit firms other than the innovator. The social benefit of an invention, once the firm accounts for these spillovers, typically exceeds the private benefit to the inventor. If inventors could receive a greater share of the broader social benefits for their work, they would have a greater incentive to seek out new inventions.

13.2 How Governments Can Encourage Innovation

Learning Objectives

By the end of this section, you will be able to:

- Explain the effects of intellectual property rights on social and private rates of return.

- Identify three U.S. government policies, and explain how they encourage innovation.

Several different government policies can increase the incentives to innovate, including guaranteeing intellectual property rights, government assistance with the costs of research and development, and cooperative research ventures between universities and companies.

Intellectual Property Rights

One way to increase new technology is to guarantee the innovator an exclusive right to that new product or process. Intellectual property rights include patents, which give the inventor the exclusive legal right to make, use, or sell the invention for a limited time, and copyright laws, which give the creator an exclusive legal right over a variety of creative works, such as books, songs, videos, and photographs. For example, if a pharmaceutical firm has a patent on a new drug, then no other firm can manufacture or sell that drug for 20 years unless the firm with the patent grants permission. Without a patent, the pharmaceutical firm would face competition for its successful products and could earn no more than a normal rate of profit. With a patent, a firm is able to earn monopoly profits on its product for a period of time, which offers an incentive for research and development. In general, how long can “a period of time” be? The Clear It Up discusses patent and copyright protection timeframes for some works you might know.

Clear It Up

How Long Is Mickey Mouse Protected From Being Copied?

All patents and copyrights are scheduled to end someday. In 2003, copyright protection for Mickey Mouse was scheduled to run out. Once the copyright had expired, anyone would be able to copy Mickey Mouse cartoons or draw and sell new ones. In 1998, however, Congress passed the Sonny Bono Copyright Term Extension Act. For copyrights owned by companies or other entities, it increased or extended the copyright from 75 years to 95 years after publication. For copyrights owned by individuals, it increased or extended the copyright coverage from 50 years to 70 years after death. Along with protecting Mickey for another 20 years, the copyright extension affected about 400,000 books, movies, and songs.

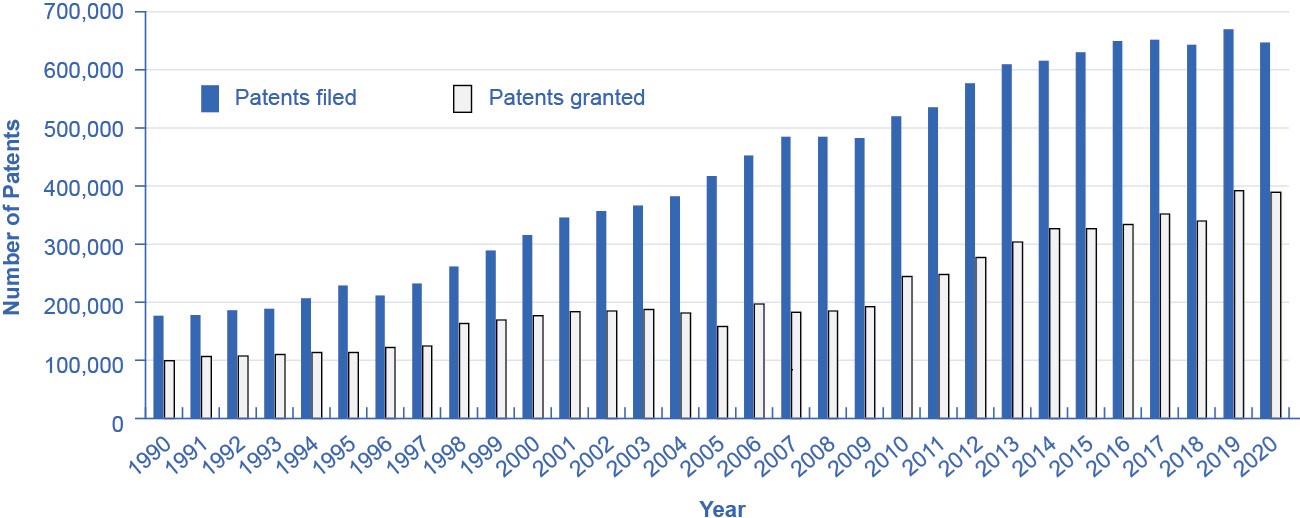

Figure 13.4 illustrates how the total number of patent applications filed with the U.S. Patent and Trademark Office, as well as the total number of patents granted, surged in the mid-1990s with the invention of the internet.

Although patents provide an incentive to innovate by protecting the innovator, they are not perfect. For example:

- In countries that already have patents, economic studies show that inventors receive only one third to one half of the total economic value of their inventions.

- In a fast-moving, high-technology industry, such as biotechnology or semiconductor design, patents may be almost irrelevant because technology is advancing so quickly.

- Not every new idea can be protected with a patent or a copyright. For example, it would be almost impossible to get a patent protecting a new way of organizing a factory or a new way of writing a memo to employees.

- Patents may sometimes cover too much or be granted too easily. In the early 1970s, Xerox held over 1,700 patents on various elements of the photocopy machine. Every time Xerox improved the photocopier, it received a patent on the improvement.

- The 20-year period for a patent is somewhat arbitrary. Ideally, a patent should cover a long enough period for the inventor to earn a good return, but not so long that it allows the inventor to charge a monopoly price permanently.

Because patents are imperfect and do not apply well to all situations, alternative methods of improving the rate of return for inventors of new technology are desirable. The following sections describe some of these possible alternative policies.

Policy #1: Government Spending on Research and Development

If the private sector does not have sufficient incentive to carry out research and development, one possibility is for the government to fund such work directly. Government spending can provide direct financial support for research and development (R&D) conducted at colleges and universities, nonprofit research entities, and sometimes by private firms, as well as at government-run laboratories. Although government spending on R&D produces technology that is broadly available for firms to use, it costs taxpayers money and can sometimes be directed more for political than for scientific or economic reasons.

The first column of Table 13.3 shows the sources of total U.S. spending on R&D. The second column shows the total dollars of R&D funding by source. The third column shows that 22.7% of total spending on R&D is done by the federal government, about 69% of R&D is done by industry, and less than 4% is done by universities and colleges (note that the percentages in the table do not add up to exactly 100% due to rounding).

|

Amount ($ billions) |

Percent of the total |

|

|---|---|---|

|

Federal government |

$129.6 |

21.4% |

|

Industry |

$426.0 |

70.3% |

|

Universities and colleges |

$20.7 |

3.4% |

|

Nonprofits |

$25.0 |

4.1% |

|

Nonfederal government |

$4.8 |

0.8% |

|

Total |

$606.1 |

|

In the 1960s, the federal government paid for about two thirds of the nation’s R&D. Over time, the U.S. economy has come to rely much more heavily on industry-funded R&D. The federal government has tried to focus its direct R&D spending on areas where private firms are not as active. One difficulty with direct government support of R&D is that it inevitably involves political decisions about which projects are worthy. The scientific question of whether research is worthwhile can easily become entangled with considerations like the location of the congressional district in which the research funding is spent.

Policy #2: Tax Breaks for Research and Development

A complementary approach to supporting R&D that does not involve the government’s scrutiny of specific projects is to give firms a reduction in taxes depending on how much research and development they do. The federal government refers to this policy as the research and experimentation (R&E) tax credit. According to the Treasury Department:

the R&E Credit is also a cost-effective policy for stimulating additional private sector investment. Most recent studies find that each dollar of foregone tax revenue through the R&E Tax Credit causes firms to invest at least a dollar in R&D, with some studies finding a benefit to cost ratio of 2 or 2.96.

Policy #3 Cooperative Research

State and federal governments support research in a variety of ways. For example, United for Medical Research, a coalition of groups that seek funding for the National Institutes of Health, which is supported by federal grants, states, “NIH-supported research added $69 billion to our GDP and supported seven million jobs in 2011 alone.” The United States remains the leading sponsor of medical-related research, spending $117 billion in 2011. Other institutions, such as the National Academy of Sciences and the National Academy of Engineering, receive federal grants for innovative projects. The Agriculture and Food Research Initiative (AFRI) at the United States Department of Agriculture awards federal grants to projects that apply the best science to the most important agricultural problems, including everything from food safety to childhood obesity. Cooperation between government-funded universities, academies, and the private sector can spur product innovation and create whole new industries.

Key Concepts and Summary

13.2 How Governments Can Encourage Innovation

Public policy regarding technology must often strike a balance. For example, patents provide an incentive for inventors, but they should be limited to genuinely new inventions and should not last forever.

The government has a variety of policy tools for increasing the rate of return for new technology and encouraging its development, including direct government funding of R&D, tax incentives for R&D, protection of intellectual property, and encouraging cooperative relationships between universities and the private sector.

13.3 Public Goods

Learning Objectives

By the end of this section, you will be able to:

- Identify a public good using nonexcludable and nonrival as criteria.

- Explain the free rider problem.

- Identify several sources of public goods.

- Recognize inefficient allocation of resources in public goods.

Even though new technology creates positive externalities so that perhaps one half or two thirds of the social benefit of new inventions spills over to others, the inventor still receives some private return. What about a situation where the positive externalities are so extensive that private firms could not expect to receive any of the social benefit? We call this kind of good a public good. Spending on national defense is a good example of a public good. Let’s begin by defining the characteristics of a public good and discussing why these characteristics make it difficult for private firms to supply public goods. Then we will see how the government may step in to address the issue.

The Definition of a Public Good

Economists have a strict definition of a public good, and it does not necessarily include all goods financed through taxes. To understand the defining characteristics of a public good, first consider an ordinary private good, such as a piece of pizza. We can buy and sell a piece of pizza fairly easily because it is a separate and identifiable item. However, public goods are not separate and identifiable in this way.

Instead, public goods have two defining characteristics: nonexcludability and nonrivalry. The first characteristic, that a public good is nonexcludable, means that it is costly or impossible to exclude someone from using the good. If Larry buys a private good, such as a piece of pizza, then he can exclude others, like Lorna, from eating that pizza. However, if national defense is provided, then it includes everyone. Even if you strongly disagree with America’s defense policies or with the level of defense spending, the national defense still protects you. You cannot choose to be unprotected, and national defense cannot protect everyone else and exclude you.

The second main characteristic of a public good, that it is nonrival, means that when one person uses the public good, another can also use it. With a private good like pizza, if Max is eating a piece of pizza, then Michelle cannot also eat the same piece of pizza—that is, the two people are rivals in consumption. With a public good like national defense, Max’s consumption of national defense does not reduce the amount left for Michelle, so they are nonrival in this area.

A number of government services are examples of public goods. For instance, when firefighters work to contain and extinguish a wildfire, the services they are providing benefit everyone living in a nearby town, not just a select few residents. Protecting some necessarily means protecting others, too.

Positive externalities and public goods are closely related concepts. Public goods have positive externalities, such as safer neighborhoods or healthier communities. However, not all goods and services with positive externalities are public goods. For example, investments in education have huge positive spillovers, but education can be provided by a private company. Private companies can invest in new inventions such as the Apple iPad and reap profits that may not capture all of the social benefits. We can also describe patents as an attempt to make new inventions into private goods, which are excludable and rivalrous, so that no one but the inventor can use them during the length of the patent.

Classification of Goods

We can use two important characteristics of goods to classify them into four categories, as shown in Table 13.4:

- excludability: the property of the good whereby an individual can be prevented from using it

- rivalry: the property of the good whereby an individual’s use diminishes other people’s use

| Rivalrous or nonrivalrous? | Excludable | Nonexcludable |

| Rivalrous | Private goods: Cars, clothing, foods, and other consumer goods | Common goods: Fish in the ocean, shared grazing |

| Nonrivalrous | Club goods: Satellite TV, private parks, Netflix | Public goods: Tornado sirens, national defense, air, street lights |

The Free Rider Problem of Public Goods

Private companies find it difficult to produce public goods. If a good or service is nonexcludable so that it is impossible or very costly to exclude people from using this good or service, then how can a firm charge people for it?

Link It Up

Visit this website to read about a connection between free riders and “bad music.”

When individuals make decisions about buying a public good, a free rider problem can arise, which is when people have an incentive to let others pay for the public good and “ride for free” on the purchases of others. We can express the free rider problem in terms of the prisoner’s dilemma game, which we discussed as a representation of oligopoly in Monopolistic Competition and Oligopoly.

However, there is a dilemma with the prisoner’s dilemma. See the Work It Out feature.

Work It Out

The Problem With the Prisoner’s Dilemma

Suppose two people, Rachel and Samuel, are considering purchasing a public good. The difficulty with the prisoner’s dilemma arises as each person thinks through their strategic choices.

Step 1. Rachel reasons in this way: If Samuel does not contribute, then I would be a fool to contribute. However, if Samuel does contribute, then I can come out ahead by not contributing.

Step 2. Either way, I should choose not to contribute, and instead hope that I can be a free rider who uses the public good paid for by Samuel.

Step 3. Samuel reasons the same way about Rachel.

Step 4. When both people reason in that way, the public good never gets built, and there is no movement toward the option where everyone cooperates, which is the option that is best for all parties.

The Role of Government in Paying for Public Goods

The key insight in paying for public goods is to find a way of assuring that everyone will make a contribution, thus preventing free riders. For example, if people come together through the political process and agree to pay taxes and make group decisions about the quantity of public goods, they can defeat the free rider problem by requiring, through the law, that everyone contributes.

However, government spending and taxes are not the only way to provide public goods. In some cases, markets can produce public goods. For example, think about radio. It is nonexcludable because once the radio signal is broadcast, it would be very difficult to stop someone from receiving it. It is nonrival, because one person listening to the signal does not prevent others from listening as well. Due to these features, it is practically impossible to charge listeners directly for listening to conventional radio broadcasts.

Radio has found a way to collect revenue by selling advertising, which is an indirect way of “charging” listeners by taking up some of their time. Ultimately, consumers who purchase the advertised goods and services are also paying for the radio service, because the producers of the goods and services build the cost of advertising into the product cost. In a more recent development, satellite radio companies, such as SiriusXM, charge a regular subscription fee for streaming music without commercials. In this case, however, the product is excludable, because only those who pay for the subscription will receive the broadcast.

Some public goods will also have a mixture of public provision at no charge, along with fees for some purposes. For example, a public city park is free to use, but the government charges a fee for parking your car, for reserving certain picnic grounds, and for food sold at a refreshment stand.

Segregation and Racial Inequality in Public Goods

The article “Segregation and Inequality in Public Goods” by Jessica Trounstine from UC Merced explains how segregation along racial lines contributes to public goods inequality. Trounstine examines how racial segregation in U.S. cities contributes to inequalities in the provision of public goods. Key points include:

- Segregation, rather than diversity, is a critical driver of disparities in public goods provision. Segregated cities are more politically polarized, which reduces collective investment and public expenditure.

- The study analyzes election data from 25 large cities (1990–2010) and financial and demographic data from over 2,600 cities (1982–2007). An instrumental variable approach using the number of waterways is employed to address endogeneity. Segregated cities are found to spend less on public goods, including roads, police, parks, and social welfare programs.

- Residential segregation leads to racial divisions in political priorities, making consensus on taxation and public spending harder to achieve. Segregated cities show larger racial divides in voter support for candidates. The lack of investment in segregated minority communities contributes to racial inequality in education, health, safety, and economic opportunities. Segregation amplifies disparities, as White residents are often insulated from resource scarcity while minority communities bear its brunt.

- Segregation negatively impacts per capita expenditures on public services. This pattern persists even when accounting for diversity, city demographics, and ideological differences.

- Segregation creates inequalities in public goods access, disproportionately disadvantaging racial and ethnic minorities. As the United States becomes more diverse, these patterns of segregation contribute to growing inequality.

Check Your Learning

(Learning Outcome: Recognize inefficient allocation of resources in public goods)

In some cases, we can use social pressures and personal appeals, rather than the force of law, to reduce the number of free riders and to collect resources for the public good. For example, neighbors sometimes form an association to carry out beautification projects or to patrol their area after dark to discourage crime. In low-income countries, social pressure may prompt all the farmers in a region to come together to work on a large irrigation project that will benefit all. We can view many fundraising efforts, including raising money for local charities and the endowments of colleges and universities, as an attempt to use social pressure to discourage free riding and generate the outcome that will produce a public benefit.

Check Your Learning

(Learning Outcome: Identify a public good using nonexcludable and nonrival as criteria.)

Common Resources and the “Tragedy of the Commons”

Some goods do not fall neatly into the categories of “private good” or “public good.” While it is easy to classify a pizza as a private good and a city park as a public good, what about an item that is nonexcludable and rivalrous, such as the queen conch?

In the Caribbean, the queen conch is a large marine mollusk that lives among the seagrass in shallow water. The water is so shallow and so clear that a single diver can harvest many conch in a single day. Not only is conch meat a local delicacy and an important part of the local diet, but artists also use the large ornate shells, and craftspeople transform them. Because almost anyone with a small boat, snorkel, and mask can participate in the conch harvest, it is essentially nonexcludable. At the same time, fishing for conch is rivalrous. Once a diver catches one conch, another diver cannot catch it.

We call goods that are nonexcludable and rivalrous common resources. However, because the waters of the Caribbean are open to anyone who wants to catch conch, and because any conch that you catch is a conch that I cannot catch, people tend to overharvest the conch.

The problem of overharvesting common resources is not a new one, but ecologist Garret Hardin put the tag “tragedy of the commons” to the problem in a 1968 article in the magazine Science. Economists view this as a problem of property rights. Because nobody owns the ocean, or the conch that crawl on the sand beneath it, no one individual has an incentive to protect that resource and responsibly harvest it. To address the issue of overharvesting conch and other marine fisheries, economists have advocated simple devices like fishing licenses, harvest limits, and shorter fishing seasons. One approach that has been turned to more recently is the implementation of catch shares, whereby regulators establish a total allowable catch, and then individuals are allocated a portion of that total allowable catch. Catch shares appear to slow the race to fish. When the population of a species drops to critically low numbers, governments have even banned the harvest until biologists determine that the population has returned to sustainable levels. In fact, such is the case with the conch, the harvesting of which the government has effectively banned in the United States since 1986.

The tragedy of the commons is a frequent economic and social framework for discussions about a range of common resources, even extending into digital resources, such as open media repositories and online libraries. Prominent economist Elinor Ostrom, the first woman to receive the Nobel Prize in Economics, proposed an alternate version, sometimes referred to as the “nontragedy of the commons.” After extensive fieldwork in areas as diverse as Indonesia, Kenya, Maine (in the United States), and Nepal, she challenged the notion that people would only avoid depletion of common resources if they were forced to by regulatory laws and property rights. She noted that farmers working shared land could communicate and cooperate to maximize and preserve the fields over time. She argued that when those who benefit most from a resource are close to it (like a farm field that directly serves a town), the resource is better managed without external influence.

Link It Up

Visit this website for more on the queen conch industry.

Positive Externalities in Public Health Programs

One of the most remarkable changes in the standard of living in the last several centuries is that people are living longer. Scientists believe that, thousands of years ago, human life expectancy ranged between 20 to 30 years. By 1900, the average life expectancy in the United States was 47 years. By 2015, life expectancy was 79 years; however, due to COVID-19, life expectancy declined slightly to 77 years in 2020. Most of the gains in life expectancy in the history of the human race happened in the 20th century.

The rise in life expectancy seems to stem from three primary factors. First, systems for providing clean water and disposing of human waste have helped to prevent the transmission of many diseases. Second, changes in public behavior have advanced health. Early in the 20th century, for example, people learned the importance of washing their hands, protecting food from flies, and boiling bottles before using them for food storage and babies’ milk. More recent behavioral changes include reducing the number of people who smoke tobacco and taking precautions to limit sexually transmitted diseases. Third, medicine has played a large role. Scientists developed immunizations for diphtheria, cholera, pertussis, tuberculosis, tetanus, and yellow fever between 1890 and 1930. Penicillin, discovered in 1941, led to a series of other antibiotic drugs that helped bring bacterial infectious diseases under control. In recent decades, drugs that reduce the risks of high blood pressure have had a dramatic effect on extending lives.

These advances in public health have all been closely linked to positive externalities and public goods. Public health officials taught hygienic practices to mothers in the early 1900s and encouraged less smoking in the late 1900s. The government funded many public sanitation systems and storm sewers because they have the key traits of public goods. In the 20th century, many medical discoveries emerged from government or university-funded research. Patents and intellectual property rights provided an additional incentive for private inventors. Phrased in economic terms, the reason for requiring immunizations is that, in addition to protecting the immunized person, they prevent spillover of illness to others.

Bring It Home

The Benefits of Voyager I Endure

Although we applaud the technology spillovers of NASA’s space projects, we should also acknowledge that those benefits are not shared equally. Economists like Tyler Cowen, a professor at George Mason University, are seeing increasing evidence of a widening gap between those who have access to rapidly improving technology and those who do not. According to Cowen, author of the 2013 book Average Is Over: Powering America Beyond the Age of the Great Stagnation, this inequality in access to technology and information is going to deepen the inequality in skills, and ultimately, in wages and global standards of living.

Key Concepts and Summary

13.3 Public Goods

A public good has two key characteristics: it is nonexcludable, and it is nonrival. Nonexcludable means that it is costly or impossible for one user to exclude others from using the good. Nonrival means that when one person uses the good, it does not prevent others from using it. Markets often have a difficult time producing public goods because free riders will attempt to use the public good without paying for it. One can overcome the free rider problem by implementing measures to ensure that users of the public good pay for it. Such measures include government actions, social pressures, and specific situations where markets have discovered a way to collect payments.

Media Attributions

- Voyager’s View of Jupiter’s Great Red Spot © NASA/JPL adapted by OpenStax is licensed under a Public Domain license

- Positive Externalities and Technology © OpenStax is licensed under a CC BY (Attribution) license

- The Market for Flu Shots with Spillover Benefits (A Positive Externality) © OpenStax is licensed under a CC BY (Attribution) license

- Patents Filed and Granted, 1990–2020 © U.S. Patent and Trademark Office adapted by OpenStax is licensed under a Public Domain license